Please explain, Pauline Hanson: Why didn't you declare your $1.1m property?

Senator Hanson's statement to the Register of Senators’ Interests last week is one of the strangest we've seen: she declared no longer receiving rental income from a property she never declared to the register.

Sean Johnson8 May 2023

Federal parliament's resident racist is well known for her limited vocabulary, with a 60 Minutes interview in 1996 revealing she didn’t know what xenophobic meant, but it seems her malady extends to not understanding common terms like ‘real estate’.

At least that’s the most charitable explanation.

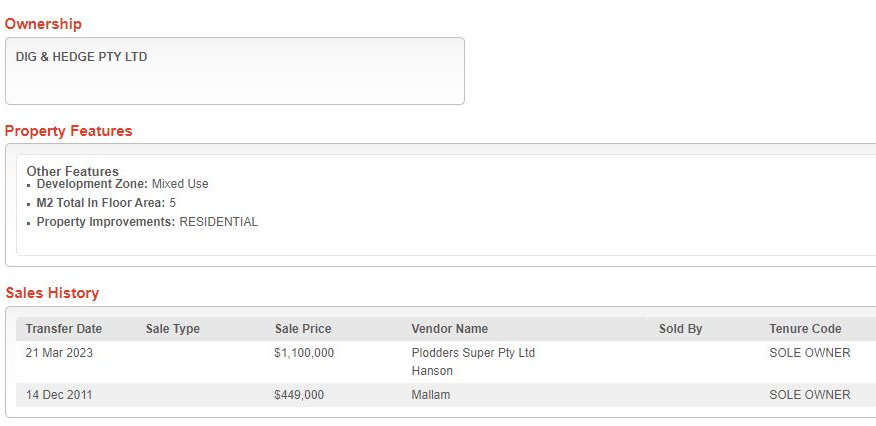

In 2011 Hanson and another investor bought the premises of the former Exchange Hotel in Maitland for $449,000, as reported at the time by property journalist Jonathan Chancellor and confirmed by land title records.

Hanson told Chancellor she toyed with getting back on the tools and opening a fish and chip shop on the site before deciding with her co-investors to lease out the bar and redevelop the upstairs accommodation as residential apartments. (Locals were thankfully spared her patented recipe of battered hake and potato scallops.)

Alas, she’s been less forthcoming with the Senate about the property. When the senator returned to parliament in 2016 after an 18 year absence she never bothered to declare the property in Section 3 Real Estate of her statement to the 45th parliament’s Register of Senators’ Interests.

Nor did she do so in her initial statements at the start of the 46th and the 47th parliaments. And she failed to inform the parliament when she sold the property on 21 March 2023 for $1.1 million.

Incredible. As her pen hovered over the real estate sections of three separate statements she seemingly never thought, ‘Oh, I should probably declare that investment property in Maitland.’ But every time she dutifully recorded rental income from said property.

That takes a special brand of incompetence.

Her actions are also a breach of the register resolutions on two counts: one, for failing to declare in 2016, 2019 and 2022 that she owned the property; and two, for not declaring within 28 days (18 April 2023) that she sold the property. Hanson appears to suffer from innumeracy too.

And if the breach was deliberate, Hanson could be found guilty of serious contempt of the Senate and dealt with accordingly, though she's unlikely to end up in the Senate dungeon as the rules are never enforced.

Besides, she'd have a strong case pleading stupidity.