Scale Facilitation's inflated invoice to UK subsidiary raises questions about VAT refund

Scale Facilitation was raided in June by the Australian Federal Police over an alleged $76m tax fraud and now tax experts in the UK are calling on authorities there to investigate the firm over its Value Added Tax (VAT) returns.

Sean Johnson9 January 2024

As Scale Facilitation’s CEO David Collard scrambled to find money to pay late wages and make overdue payments to buy failed battery start up Britishvolt, his company issued an invoice with inflated expenses to a UK subsidiary which boosted the VAT refund the group could claim from HM Revenue & Customs, Open Politics can reveal.

On 27 February Scale subsidiary Recharge Production UK Limited was named the winning £8.57m bidder for Britishvolt, which had plans to develop a gigafactory in Northumberland in the north of England to make lithium-ion batteries for electric cars before collapsing in a mountain of debt.

Deputy Prime Minister Richard Marles described David Collard at the HQ opening as “force of nature…innately entrepreneurial…values driven”.

But by 5 April the deal itself was on the verge of collapse after Recharge failed to make the final instalment payment to Britishvolt’s administrator EY of around £2.1m and pay secured creditor Katch Solutions £9.7m for the land on which the gigafactory was to be built.

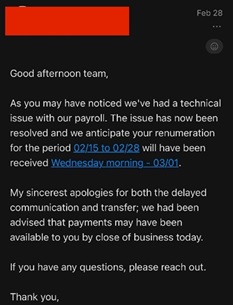

At the same time Scale Facilitation was not paying its staff in Australia and the United States, a problem which first emerged a day after Recharge inked the Britishvolt deal.

Email from Scale Facilitation’s HR department to US staff

Taxman to the rescue?

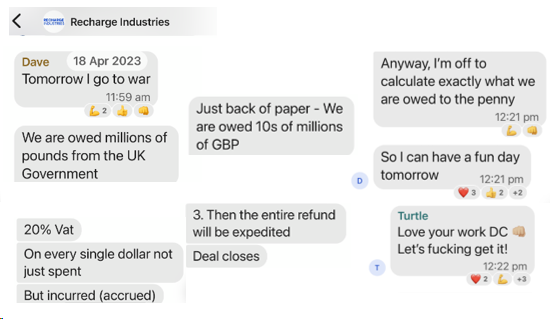

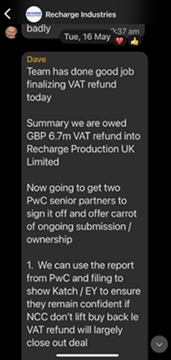

Amidst these financial pressures and likely insolvency, Collard told staff on encrypted messaging app Signal that the company was owed tens of millions in VAT refunds and that this would provide funding to close the Britishvolt deal.

Selected parts of Collard’s messages, 18 April. Turtle is the Entourage-inspired nickname of Jimmy Fatone.

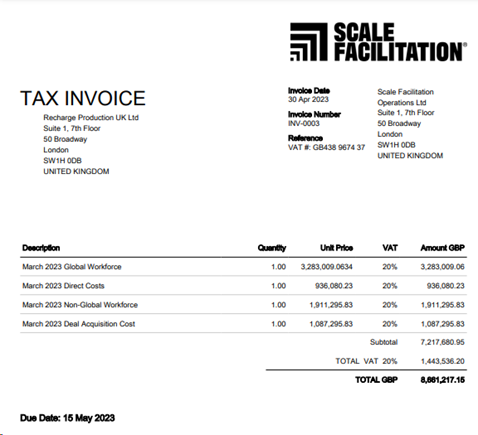

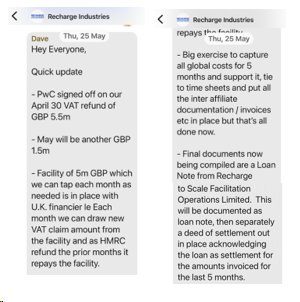

Soon after, on 30 April, another of Scale’s UK subsidiaries, Scale Facilitation Operations Limited, invoiced Recharge Production UK for £8.66m (£7.22m + £1.44m in VAT) for ‘services’ provided by subsidiaries in Australia, the United States, and India in March.

Personal names have been redacted at the request of former staff.

However our discussions with former Scale staff and external advisers reveals the invoice includes invented and inflated expenses.

“All hours were wildly inflated to up the VAT component”

The invoice states global workforce expenses were £3.28m plus £656,601 VAT, with 77 employees listed as collectively doing 8,660 hours for Recharge at a charge out rate of £379 an hour.

A former senior executive of Scale Facilitation who leaked the invoice to us says that when David Collard distributed the invoice to staff on 25 May it immediately struck them as “not right”.

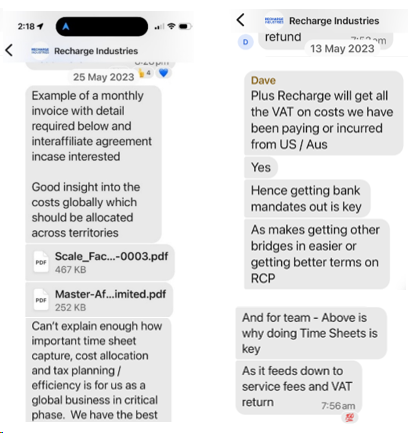

On 25 May David Collard said the invoice was an example of how global costs should be allocated to Recharge. A message on 13 May says, “doing time sheets is key” because “it feeds down to service fees and [Recharge’s] VAT return.”

The executive alleges that at least half of the employees on the timesheet attached to the invoice “did absolutely no work whatsoever” on Britishvolt and that “ALL hours were wildly inflated to up the VAT component”, enabling Recharge Production UK to “claim back millions in VAT from HMRC.”

This was, they said, “a carefully constructed fraud.”

Credit: Xero. As occurs in Australia with the GST, UK businesses are entitled to a VAT refund if the VAT they’ve paid on purchases exceeds the VAT collected on sales.

They pointed to two very senior former Recharge staff in Australia, whom we’ve chosen not to name, as an example of invented hours. They were “wholly focused on the Avalon [gigafactory] project in Australia and not engaged with UK stakeholders. I know that both of these men did not attribute those hours to the UK themselves.”

If true, Scale has invoiced Recharge £242,139 for work that was never done and helped Recharge inflate its VAT refund claim by £48,427.

Opposition Leader Peter Dutton was flown to New York at the company's expense. He said in his speech at the HQ opening that David Collard was "a superman" with “the ability to see around corners and over the horizon.”

The former executive tried to talk to Collard about their concerns, but he shot them down, saying, ‘you’re not a finance person’. Collard’s response, together the executive’s existing doubts about Scale’s claims for the Australian government’s R&D Tax Incentive, led them to resign soon after. Another colleague walked with them.

Open Politics cannot verify that half of the employees on the invoice didn’t work on the UK, but a former senior employee who was heavily involved in the Britishvolt transaction told us all hours were inflated.

And they backed up the executive’s other claim that two senior Recharge staff didn’t do any hours on Britishvolt, though we’ve been unable to confirm this with the individuals concerned.

“I put down a random number”

We’ve also spoken with former staff in Australia and the United States who say their hours have been massively overstated.

One employee had their hours inflated by around 700%, and says their manager strongly encouraged their team to attribute a high percentage of their hours - about 70-90% - to Recharge Production UK regardless of whether they did any work for the subsidiary.

“I put down a random number that fitted with what we were being asked to do,” they said.

Collard felt he needed to offer his tax advisers PwC UK a ‘carrot’ in the form of ongoing VAT filing work to get them to sign off on the £6.7m VAT claim. PwC’s validation of the claim was to be used by Collard to convince Britishvolt’s administrator EY and creditor Katch that the VAT refund would help close the deal.

Another employee’s hours were exaggerated by about 1000%. Seeing their false hours on the invoice did not come as a surprise to them as they said Scale Facilitation had a history of falsely attributing hours to inflate claims for research grants from the Australian government.

A third employee, who had their hours increased by 240%, said it would’ve been impossible for them to do the hours stated as they were on holidays for a good chunk of the invoice period.

Open Politics estimates that for these employees alone Recharge would have been able to inflate its VAT refund claim by at least £12,000.

David Collard is listed as working the most hours of anyone in the company: 380 hours, or 16.5 hours every weekday in March, at a total cost to Recharge of £144,020 plus VAT of £28,804.

And Collard’s close friend and Scale’s Chief of Staff Jimmy Fatone apparently worked 293 hours in March or 12.7 hours a day, though a well-placed source says the former fishmonger and railway station manager did nothing of consequence.

Incredible too is Scale’s staff charge out rate of £379 (A$717) an hour. A rate this high raises questions about whether the invoice complies with UK transfer pricing rules, which seek to prevent tax avoidance by requiring transactions between related entities to be conducted at arm’s length and priced as if between two unrelated entities.

Inflated vendor expenses

The invoice includes non-global workforce charges of £1.9 million plus VAT of £382,259 for 77 itemised expenses from various consultants, suppliers and creditors.

One consultant on the list provided Open Politics with timesheet summaries showing they did very little work on Recharge Production UK, meaning their services have been inflated by around 1900%.

Another we spoke to said they did not work on the UK in the March invoice period, and only a miniscule number of hours in previous months, so their expenses have been almost entirely made up. This increased the VAT component on both vendors’ services by over £4,800.

The invoice lists two people as simultaneously providing services as consultants and employees, but we understand neither was engaged as an employee and only one did any work on the UK (and very few hours at that). This would mean the invoice has inflated the cost of their services by £156,330 and VAT by £31,266.

Bursary payment and other peculiar charges

There are also red flags about some of the invoice’s indirect costs, which are expenses Scale says it incurred in providing services to Recharge which could not be directly attributed to a particular service. Things like office rent, IT costs, electricity bills, and travel costs.

While the leaked master affiliate agreement between Scale Facilitation Partners LLC and Recharge permits Scale Facilitation Operations (the aqreement’s service provider) to invoice for indirect costs, the size and nature of a number of charges are extraordinary.

Recharge was invoiced £479,980 plus £95,996 VAT for costs incurred by Scale’s US company 3C USA LLC for ‘Fitout (including Skyward Media)’, which a source says could be connected to an expensive digital fit out of some of Scale’s offices at the One World Trade Center in New York.

As for Skyward Media, the only US companies we could find with that name are a Texan digital marketing company that builds websites for real estate agents and an Illinois digital video production outfit.

A further £432,749 plus £86,549 VAT was charged for costs incurred by Scale Facilitation Operations India Private Limited (which had just a handful of staff and no public record of doing anything) in engaging RMZ. The only company we could find called RMZ is RMZ Corp, an Indian real estate investor that develops office buildings in India.

And then there’s £5,500 plus £1,100 VAT for ‘bursary payment’. This could be for the Fatone & Collard Bursary that Jimmy and Dave established with much fanfare in 2022 at their old school, St Joseph’s College Geelong. Why was Recharge, or indeed any company, charged for a bursary named after Fatone and Collard?

Jimmy Fatone and David Collard announcing the bursary.

VAT claims

Sources have told us the 30 April invoice was one of several issued to Recharge in an effort to extract £6.7 – 7m in VAT refunds from HMRC.

We also understand that soon after Recharge received its VAT number on 6 June the company began lodging VAT returns with HMRC and received an advance payment of over £1m from a finance firm on a percentage of its expected VAT refunds.

We hear too that HMRC made at least one VAT repayment before the AFP raid later that month.

Recharge would need to have paid the relevant invoices within six months of receiving the refund to avoid it being clawed back by HMRC, though it’s unclear how the company was in a position to pay tens of millions of pounds given it has never been able to make the final payments of around £11.8m for Britishvolt.

Part of the answer can be found in Collard’s staff message of 25 May that a loan note between the two parties “will be considered ‘consideration’ to settle the amounts owed” from Scale’s invoices from January to May. But we’re still left wondering where Recharge found money to loan Scale.

“HMRC should investigate”

Whatever the case, and however many VAT returns were filed, one thing is clear: someone has committed tax fraud if a return has been filed based on invented and inflated expenses like those in the 30 April invoice.

UK tax expert Dan Neidle, the founder of Tax Policy Associates and former head of UK tax at leading law firm Clifford Chance, told Open Politics: “If Scale Facilitation did falsify an invoice to obtain a tax or VAT benefit then that looks like tax fraud - a criminal offence. HMRC should investigate."

Claire Ralph, Director of investigative think tank Tax Watch UK, reiterated Neidle’s comments, telling us that “a VAT refund can only be legally claimed for business expenses paid in relation to services provided in the UK.”

“If evidence shows some invoiced services were not supplied to Recharge Production UK Limited, HMRC should audit the claim and recover any VAT erroneously reclaimed.”

Tax Watch UK said that HMRC would also need to consider whether penalties and interest are due. An accidental VAT refund or repayment claim can lead to HMRC issuing a fine of up to 30% of the amount owed. This increases to 70% if the VAT fraud was deliberate and up to 100% if found to be deliberate and concealed.

David Collard said in a statement that “no international time or expenses have ever been claimed for U.K. VAT purposes”, which is hard to square with his Signal messages and emails showing he planned to do precisely that.

Collard added that the company’s “VAT returns were compiled by an independent compliance firm after receiving tax compliance guidance from multiple independent firms. After submission of the VAT returns, they were subsequently audited by the regulator and no issues noted.”

Open Politics asked PwC UK if they validated Recharge's VAT refund claim, and whether Collard offered an inducement to do so, but a spokesperson declined to comment.