The company they keep: where MPs invest

Open Politics' analysis shows which public companies and industries are popular investments with federal MPs, who the big shareholders and traders are, and highlights potential conflicts of interest.

Sean Johnson25 February 2023

Financial Review's coverage of story

50 politicians or 22% of the parliament own shares in publicly listed companies, and at least 39 have spouses and dependent children with shares too, an analysis of the members' and senators' interests registers has revealed.

All up, Open Politics identified a total of 469 shareholdings in 202 companies, though the true figures would be higher as senators are not required to publicly disclose their family interests.

That's a lot of fingers in a lot of pies. While there is no prohibition on MPs outside the ministry owning shares, or indeed ministers' families having shares, the holdings can create conflicts of interest and raise questions about whether inside government information is being used for some share trades. For these reasons, we believe there needs to be much closer scrutiny of shareholdings. Here's what we've found so far.

Most popular shares

Most popular industries

Biggest shareholders and traders

Potential conflicts of interest

Most popular shares

This table lists companies with two or more shareholdings. Collectively they comprise 72% of all holdings disclosed to the registers.

Telstra shares are not just popular with Australian retail investors. MPs seem love them too, with 33 declaring they or their family members invest in the telco, miles ahead of that other former government entity, the Commonwealth Bank, and the rest of the big four.

Most of the other companies in the top 20 (page 1 of table) are well known Australian companies in the S&P/ASX 20, including big miners and CO2 emitters, retailers, and insurers. But a couple are outliers.

Endeavour Group

Woolworths spinoff Endeavour Group, Australia's largest pokies operator with over 12,500 machines, is only around fortieth by market cap on the ASX, but it’s big with several Coalition and Labor MP shareholders: Dr David Gillespie; Graham Perrett; Ted O'Brien; Dr Michelle Ananda Rajah and her partner via their self managed super fund; and Tony Zappia. The partners of Sally Sitou and Dr Mike Freelander own shares too.

All except Sitou's partner are Woolies shareholders, so they most likely received their shares in the pokies behemoth from the demerger in June 2021. Still, let's hope their holdings don’t infect their views on alcohol taxes and pokies regulation, though to paraphrase the late writer and troublemaker Upton Sinclair, it’s hard to get someone to understand something when they have a financial interest in not doing so.

Lynas Rare Earths

Another anomaly is Lynas Rare Earths, ranked a lowly 73th on the ASX but the 13th most popular holding. The company is the largest producer of rare earths outside China, providing critical components for smart phones, clean energy technology, and defence industries. It’s this last sector where Lynas is doing very well, winning two contracts worth over $200 million in 2020 and 2022 from the Pentagon to build a rare earths separation facility in Texas. Lynas also won a $20 million contract from the Morrison government in July 2021 to commercialise a refining process for a rare earth carbonate.

Seven MPs or their family members have Lynas shares: Graham Perrett; Dr Gordon Reid; Dr Michelle Ananda Rajah and her partner via their SMSF; Meryl Swanson and partner via SMSF; Barnaby Joyce's young son, Master Sebastian Joyce (held in trust); Warren Entsch’s partner; and Ged Kearney’s partner. Kearney herself owned shares in Lynas from February 2020 till August 2022.

Of the seven, Swanson, Kearney and Barnaby Joyce's son acquired their shares before the three contracts were awarded. They must be happy with their investments as Lynas’s share price has nearly quadrupled since the first Pentagon contract was awarded in July 2020. Master Sebastian is lucky to have a trustee who's an astute investor.

Most popular industries

Shareholdings in the top 20 industry sectors make up 96% of all holdings.

The mining sector is the clear favourite with MPs and their families, representing nearly a quarter of all holdings. Mining shares are spread across 65 companies, with the three largest being BHP (14 holdings), South32 (8), and Lynas Rare Earths (7).

The big four banks make up 80% of MPs’ shareholdings in the highly concentrated banking sector, while in retail there’s a preference for supermarket duopolies Woolworths (10 holdings) and Coles (9), along with Coles’ parent Wesfarmers (11).

Collectively, mining, banking, and retails shares comprise over 50% of all holdings on the registers.

Biggest shareholders and traders

Shareholders

Leigh Hubbard, former Victorian Trades Hall Council supremo and the partner of Assistant Health and Ageing Minister Ged Kearney, has the most shareholdings in public companies: 37. This is followed by Labor backbencher Dr Michelle Ananda Raja and her partner, who jointly own shares in 21 companies through their self managed super fund; Coalition shadow minister Rick Wilson and his partner, with 20 holdings; Coalition backbencher Paul Scarr (19); Coalition shadow minister Ted O'Brien (17); and Coalition backbencher Dr David Gillespie (13).

Sellers

Ged Kearney has been the biggest divestor since the May 2022 election. She was required to offload all 34 of her holdings around July – August 2022 after the Prime Minister amended the ministerial code of conduct to prohibit ministers owing shares. Her partner divested 13 holdings at the same time.

The third place getter is Kearney’s ministerial colleague Kristy McBain, who disposed of her eight holdings for the same reason as Kearney. More recently, Nationals Leader David Littleproud and his family divested all nine of their shareholdings in a new year’s selling spree.

Buyers

Ged Kearney's partner also takes the crown for the most buys since Labor’s victory, acquring shares in 26 companies, including Cochlear, Bluescope, Iluka Resources and Arafura Rare Earths.

Another serious buyer is Labor backbencher Dr Mike Freelander’s librarian wife Sharon, who’s bought shares in 11 companies, including in Endeavour Group, Woodside, and BHP.

Potential conflicts of interest

Open Politics has identified several potential conflicts of interest. Owning shares in a company does not necessarily mean an MP is going to favour a company's commercial interests over their public duties, however shareholdings can create an appearance of conflicts of interest and consequently damage public confidence in the decisions parliamentarians make.

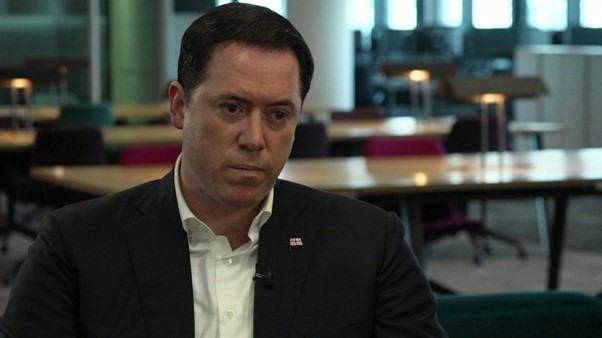

Ted O'Brien, Shadow Minister for Climate Change and Energy

LNP MP Ted O'Brien owns shares in five of Australia's one hundred largest greenhouse gas emitters: Rio Tinto (11th), Fortescue Metals Group (31st), Newcrest Mining (70th), Aurizon (75th), and Woolworths (88th). Collectively the companies emitted 10.9 million tonnes of greenhouse gases in 2020-21.

In January this year O’Brien labelled the Albanese government’s plan to toughen the safeguard mechanism a ‘carbon tax’. Coincidently, all five companies O’Brien invests in are affected by the mechanism, which requires Australia’s largest emitters to reduce their net emissions.

O’Brien held the same shares in the previous parliament when he was chair of the House of Representatives Standing Committee for Environment and Energy. In the role he opposed a private member’s bill in 2020 from Independent Andrew Wilkie to improve transparency and accountability in the reporting of greenhouse gas emissions. He also opposed a bill in 2021 from Independent Zali Steggall that would have legislated Australia’s 2050 net zero emissions target.

NB: O'Brien appears to have a habit of not declaring all his shareholdings. In previous parliaments he ‘inadvertently’ (his word) failed to disclose shares in ten companies, including Fortescue Metals Group, Newcrest Mining, Tabcorp, and The Star Entertainment Group.

Ged Kearney, Assistant Minister for Health and Aged Care

After Ged Kearney was appointed assistant minister in June 2022 her partner Leigh Hubbard bought shares in Infratil Limited, an infrastructure investment company with a majority investment in Qscan, a large Australian radiology provider, and a 50% interest in RetireAustralia, a retirement village operator which provides privately and federally-funded home care services to residents. (RetireAustralia helps residents apply for government funding for Home Care Packages.)

He also bought shares in hearing device maker Cochlear in August 2022 before disposing of them in September along with his shares in Medibank and CSL, both of which were bought before Kearney became an assistant minister. He held shares in Sonic Healthcare from December 2020 until August 2022.

Since early 2020 Hubbard has owned shares in Treasury Wine Estates, which has engaged third party lobbyists Newgate Communications and CT Group (formerly known as Crosby Textor) to help them lobby the federal government. We don’t know what issues Treasury Wine Estates is lobbying the Albanese government about, but their industry association, Australian Grape & Wine Inc (which Treasury executive Jeff McCormack is a board member of), is calling on the Albanese government to provide $85 million in funding for the wine industry in the 2023-24 Budget in May. Treasury CEO Tim Ford has also been pressing the flesh in Parliament House in February, where he spoke at a meeting of the Parliamentary Friends of Viticulture and provided free booze to ministers and other MPs.

The Albanese Government’s ministerial code of conduct recognises that the shareholdings of family members can create conflict of interests, and in section 3.15 requires ministers to “encourage family members to dispose of, or not invest in, shares in companies which operate in their area of responsibility.”

While it’s not clear what Kearney’s exact responsibilities are within the health portfolio, to our mind she should encourage Hubbard to dispose of his shares in Infratil and Treasury Wine Estates. She should also have discouraged him from investing in Infratil and Cochlear in the first place and to dispose of his shares in Medibank, CSL and Sonic Healthcare when she became minister in June. Or perhaps she did, but he didn’t listen.

Stuart Robert, Shadow Minister for Financial Services and Assistant Treasurer

LNP MP Stuart Robert owns shares in ANZ.

Rick Wilson, Member of the House Committee for Industry, Science and Resources

Liberal MP Rick Wilson owns shares in BHP (22nd biggest emitter) and Whitehaven Coal (58th). There are no conflicts of interest at this stage as the committee is yet to hold any inquiries on resources issues relevant Whitehaven’s and BHP’s commercial interests.

In the previous parliament Wilson held shares in BHP, Woodside (9th biggest emitter), Whitehaven, and Boral (42nd) when he was a member of the House Standing Committee on the Environment and Energy. He held shares in Woodside, Whitehaven and Boral in August 2020 when he joined his Coalition colleague Ted O’Brien in opposing a bill that would’ve increased transparency on emissions reporting, and he held shares in Woodside and Whitehaven in June 2021 when he opposed a bill to legislate Australia’s 2050 net zero emissions target.

David Gillespie, Deputy Chair of the House Standing Committee on Climate Change, Energy, Environment and Water

Nationals MP David Gillespie owns shares in South32 (17th biggest emitter) and Northern Star Resources (68th) while being Deputy Chair of the committee. There are no conflicts of interest at this stage as the committee has not yet held relevant inquiries on resources issues.

Gillespie held shares in both companies and BHP in the previous parliament when he was a member of the House Standing Committee on the Environment and Energy. He supported the committee’s opposition to two climate change bills.

Paul Scarr, Member of the Joint Committee on Corporations and Financial Services

LNP Senator Paul Scarr hold shares in CBA, NAB, ANZ and Westpac. The committee is currently holding an inquiry into corporate insolvency which the Australian Banking Association made a submission to. All four banks are members of the ABA.

The committee is also conducting inquiries into the corporate and financial markets regulator, ASIC. One of the inquiries is yet to call for submissions.

Deborah O’Neil, Chair of the Joint Committee on Corporations and Financial Services.

Labor Senator Deborah O'Neil owns shares in finance and insurance giant AIG and Telstra.

The committee is currently conducting inquiries into ASIC and corporate insolvency. Neither AIG nor Telstra have made submissions to the inquiries.

Dr Michelle Ananda-Rajah, Member of the House Committee for Health, Aged Care and Sport

Labor MP Michelle Ananda-Rajah owns shares in Cochlear, Resmed, Treasury Wine Estates, and alcohol and gaming company Endeavour Group.

There are no conflicts of interest at this stage as the committee is yet to hold inquiries into issues relevant to these companies. However this could well change, as the 45th parliament the committee held an inquiry into Hearing Health and Wellbeing of Australia in which Cochlear made a submission.

Jenny Ware, Member of the House Standing Committee on Health, Aged Care and Sport

Liberal MP Jenny Ware owns shares in Medibank Private. There are no conflicts of interest at this stage as the committee is yet to hold any inquiries into private health insurance or related matters.

Zaneta Mascarenhas, Member of the House Standing Committee on Industry, Science and Resources

Labor MP Zaneta Mascarenhas owns shares in Iluka Resources and mining company Sierra Rutile Holdings. There are no conflicts of interest at this stage as the committee is yet to hold any resources inquiries relevant to these companies.

Dr Mike Freelander, Chair of the House Standing Committee on Health, Aged Care and Sport

Labor MP Mike Freelander’s wife owns shares in Endeavour Group, an alcohol and gambling company. There are no conflicts of interest at this stage as the committee is yet to hold any inquiries into the health impacts of problem drinking and gambling.

This analysis does not include politicians' extensive investments in private companies, exchange traded funds, and managed funds. We may examine these in a future article.